There are three primary reasons why investors don’t get the returns they expect from their portfolios. I’m not talking about when a person makes poor investing choices out of ignorance, or when a portfolio simply underperforms expectations — those are separate issues. I’m referring specifically to someone who has carefully selected an appropriate portfolio, but then fails to get the returns they expect from that portfolio.

From what I’ve seen, the three main reasons investors underperform their expectations are the following:

1. Misunderstanding. This can take many forms. At SMI, there are a few common ones. One happens when a member’s broker reports returns in such a way that their holdings look as if they are performing worse than they really are (the culprit usually being the way distributions are accounted for). Another is misunderstanding data available to them — for example, someone taking their current Upgrading portfolio, looking up the 12-month returns for all those funds in the latest issue of SMI, and not understanding why their portfolio’s return is lower (they didn’t own those current recommendations over the full 12-month period, and almost by definition, the old funds that were replaced by the current best performers had lower performance).

Another that almost all investors are guilty of at some point is inappropriate benchmarking. I may know that my portfolio is something less than 100% stocks, but it’s such a convenient mental shortcut to just look at the S&P 500’s recent return — and then be disappointed by my portfolio’s result.

2. Timing. This one may touch a nerve, as our Upgrading 2.0 signal at the beginning of this year objectively did cost us some performance in 2019. But that’s not actually what I’m talking about here. Rather, this refers to the unfortunate, remarkably consistent pattern of investors poorly timing their investments. As a group, it’s clear that investors pile in when stocks are near bull market highs and pull money out when they fall toward bear market lows. This can be seen in many different ways — regular surveys of investors that report on portfolio positions, inflow/outflow tracking of various types of investments, and most famously/infamously the Dalbar survey.

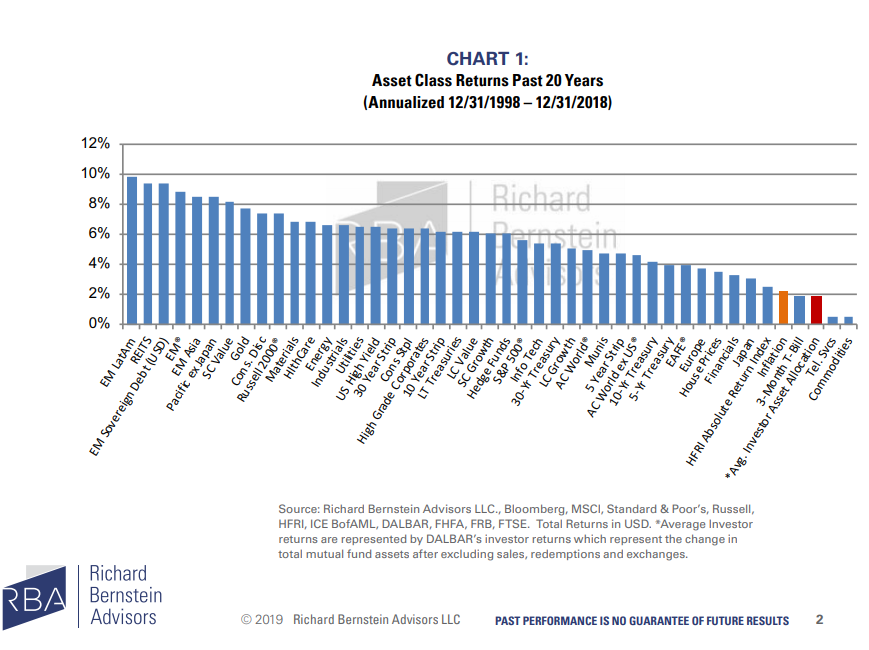

We’ve written about the Dalbar survey before because it does a great job of illustrating the point of how investors consistently underperform the specific investments they hold in their portfolios due to this type of poor timing. The chart below, created by Richard Bernstein Advisors and posted in this Michael Batnick post, shows the average investor portfolio return over the past 20 years. That’s the tiny red bar on the far right of the chart — the one that is slightly lower than the orange bar showing the rate of inflation over those 20 years, and significantly lower than virtually every other asset class (all the other bars in the chart). By putting money in and pulling money out at inopportune times, individual investors shoot themselves in the foot in a way that significantly hampers their long-term performance.

Click Chart to Enlarge

In fairness, there’s a lot of criticism about the Dalbar survey methods. That criticism seems valid and the Dalbar studies probably do overstate the degree of underperformance individual investors experience. But I’d also say that almost every advisor who has ever worked with actual clients knows there’s more than a kernal of truth to this one, even if it’s harder to quantify than Dalbar indicates. SMI was getting calls and emails from members (and potential members) for many years after the 2008-2009 bear market describing how they had sold their stocks during the last bear market, had been sitting on the sidelines ever since, and needed help getting back invested. The same was true after the 2000-2002 bear market. If you miss the first 3-4-5+ years of a new bull market — especially after selling out at some point during the depths of the prior bear market — your long-term returns are going to suffer greatly.

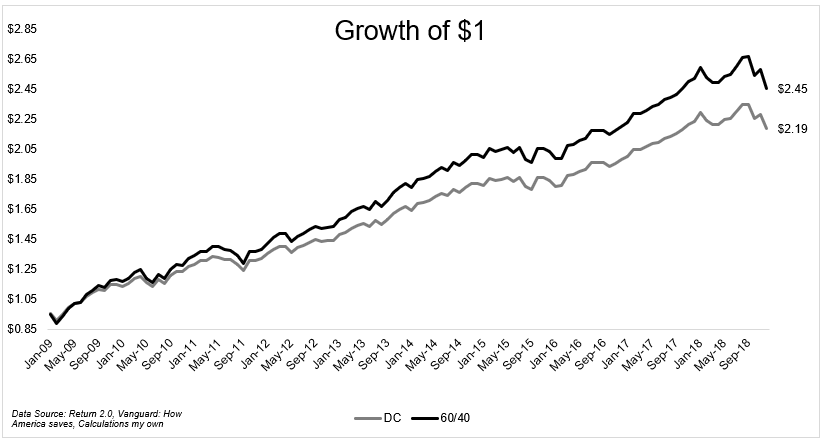

3. Cash. This is the one that surprises people as it isn’t intuitive. Batnick links in his post to a Vanguard study showing that the average cash allocation in defined contribution plans (401k, 403b, etc.) over the past 10 years has been 12.9%. He speculates, and again I agree, that it’s likely much higher than that in taxable accounts. He then takes those Vanguard findings to calculate how a simple 60/40 stock/bond portfolio — fully invested — would have compared to an otherwise identical 60/40 portfolio, only including the average cash allocation from the Vanguard study each year.

Click Graph to Enlarge

Batnick’s conclusion:

The fully invested 60/40 portfolio would have done 9.4% a year, the one less than fully invested would have done 8.13% a year.

It’s important to note that some investors may have higher cash allocations because that cash effectively functions as their emergency savings. If that’s the case, we wouldn’t encourage them to cut that cash level down (other than to perhaps find a more effective vehicle to store their cash in), because it’s important to maintain that liquid safety reserve. And it’s not as if having some small working amount of cash in your account is always a bad idea, particularly if there’s some need/use for it.

However, if you have a separate emergency savings fund (as SMI generally advocates), and you still find yourself with consistent cash holdings in your investing portfolio, you’ve got a leaking hole in your bucket. You can be doing everything else right, but you’ve got returns dribbling out of that hole unnoticed (at least during the vast majority of the time when the market is moving higher).

There are a number of reasons why cash accumulates in an investing portfolio. Most are unintentional. I’ve been guilty of letting cash accumulate in my accounts through inattention, as monthly contributions get automatically deposited but not automatically invested. Sometimes for one reason or another investors choose to not have distributions automatically reinvested, then forget to follow up and reinvest that cash. And of course, sometimes cash accumulates because we’re simply too afraid to invest it.

SMI continually works to reduce the impact of the first two reasons for trailing your expected returns — misunderstanding and poor timing — by educating members on the relevant issues, setting and managing appropriate expectations, and using mechanical strategies to minimize the risk of making bad timing decisions. But the cash issue is trickier, as it can happen even within an otherwise-well-constructed portfolio, either through inattention, fear, or other reasons.

So be alert to persistently high cash levels within your portfolio. Check back on your accounts in January to make sure any distributions have been accounted for and reinvested. Mentally commit to maintaining your target portfolio allocations — better to choose a more conservative allocation and stick closely to it than be fearful using a more aggressive allocation and let that fear drive you to keep excess cash sitting idle in your portfolio.

If you’re reading this and recognize any aspect of this has been a persistent problem for you — inattention to your portfolio, fear driving your actions/inactions, etc. — perhaps it’s time to consider having someone help you with the management of your portfolio via SMI Advisory’s Private Client service. In that case, it will likely be a huge improvement to trade the "cash drag cost" you’re already paying for professional management that can help set you — and keep you — on the right track.