Stock Upgrading is a mechanical strategy involving owning traditional mutual funds and ETFs exhibiting strong recent momentum. As that momentum fades, holdings are replaced by new selections. The simplest method of selecting funds is to purchase the recommended holdings listed on the Fund Recommendations page.

An irony of this year’s bear market is that while most investor attention has been focused on the stock market, the real fireworks have been happening in the bond and currency markets. That’s not to say the stock market’s declines haven’t been significant — the S&P 500 index is down -22.9% from its January 2022 high as this is being written in late-September, while the tech-focused Nasdaq index (-32.5%) and small-company Russell 2000 index (-31.4%) are down even more from their respective November 2021 peaks.

While those declines have been substantial, they’ve also been relatively orderly. Measured by volatility indexes such as the VIX, stocks have yet to experience any true panic selling so far.

The same can’t be said for the bond and currency markets, both of which have seen dramatic moves reminiscent of March 2020 (onset of COVID) and the 2008 Global Financial Crisis. The Japanese Yen, Chinese Yuan, and most recently the British Pound have all seen parabolic selloffs relative to the U.S. Dollar. Many currencies are down –15% to –20% this year against the dollar, which has reached its highest point of relative strength in over 20 years.

While U.S. investors tend not to feel moves in the dollar particularly acutely (given that all of our transactions take place in dollars), that is definitely not true around the rest of the globe, where the overwhelming majority of global trade — and a significant amount of global debt — is denominated in dollars, despite local citizens and businesses earning in their local currency. When local currencies weaken dramatically against the dollar, things get tough in those economies.

The significant current allocations to cash within SMI’s strategies are effectively “dollar” positions — not only are they protecting us from declining U.S. asset prices, they have quietly appreciated +15% to +20% against many other global currencies. (That helps when traveling abroad, sending charitable money overseas, and to a lesser degree on import prices.)

Persistent inflation prompting the Fed to hike interest rates has been the biggest driver of the extreme bear market in bonds this year. Over the past week (i.e., late September), the primary measure of bond market volatility (the MOVE index) has surpassed its March 2020 peak. Dysfunction in the Treasury bond market in March 2020 was the primary driver of Fed intervention then, which is why observers are growing increasingly worried about Fed tightening “breaking something” in the financial markets. Rapid increases in interest rates have historically led to such events — currency crises, sovereign bond defaults, and so on. This year’s rate increases have been the fastest ever and have been global in nature.

Against this background, our conservative positioning within the SMI strategies is especially comforting right now. Our combination of ample cash on the equity side of our portfolios, coupled with a heavy tilt toward very short-term bonds, gives us a lot of stability and only minimal exposure to the significant market risks threatening investors.

Pausing to assess

When markets get scary, it’s usually more profitable to pause and assess one’s own situation rather than spend a lot of time on the “whys” regarding the current market action. Markets are going to do what they’re going to do. We need to focus on what we can control.

With that in mind, let’s quickly pause to review how we got here, assess why we’re positioned as we are, and look forward to what our game plan is from here. Hopefully in doing so, you’ll find your confidence restored (if it was waning), your patience strengthened, and your course clarified.

Where we’ve been.

As we discussed in our January 2022 cover article, the signs pointing to this bear market were clear to those who were looking. A dozen years of ultra-low interest rates and central bank liquidity had pushed both stock and bond prices to historic extremes. Yet inflation was knocking loudly on the door at the same time many of the factors supporting the post-COVID global economic surge were waning.

Putting these factors together, the stage was set for the worst possible combination for investors: high inflation would force central bankers to raise interest rates and tighten financial conditions despite slowing economic growth. That toxic combination, coupled with valuation extremes in stocks and incredibly low interest rates, would hammer financial asset prices. That’s exactly what has happened, and there’s little reason to think it’s over. Inflation is still high, rates are still rising, and company earnings have yet to decline to the degree typically experienced during recessions.

Where we are.

The SMI strategies entered 2022 allocated aggressively, as one would expect given that the S&P 500 was still rising through early January. As a result, when the bear market began that month, it took a bit of time for our strategies to respond. However, since Jan. 28 when SMI’s February newsletter initiated our first defensive measures, SMI investors have experienced dramatically less damage than the markets as a whole.

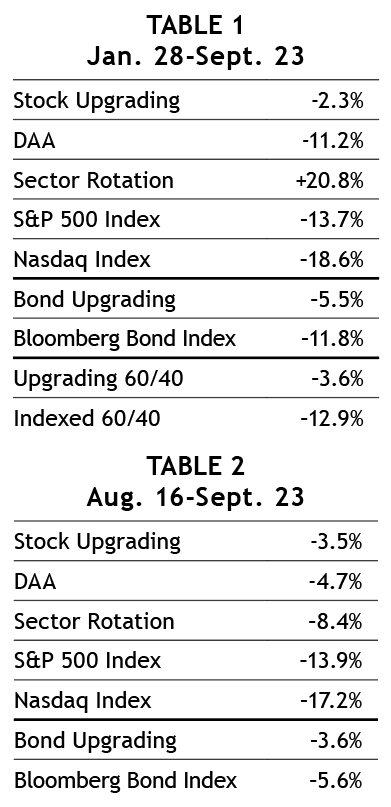

Consider Table 1 at right, showing returns from Jan. 28-Sept. 23 of this year. All three of SMI’s active stock-oriented strategies have lost less than the market indices, and Bond Upgrading has lost less than half as much as the Bloomberg U.S. Aggregate Bond Index. While an indexed 60/40 portfolio has lost -12.9% since late January, a 60/40 Fund Upgrading portfolio is down only -3.6%. (Assumes 60% allocated to an S&P 500 index fund, with 40% allocated to the Bloomberg U.S. Aggregate Bond Index. The SMI version assumes 60% allocated to Stock Upgrading and 40% allocated to Bond Upgrading.)

Widening the scope to include DAA, which has underperformed our expectations, but also SR which has outperformed expectations, a 50/40/10 portfolio (not shown) has lost just -5.0% since late January, less than half the loss of an indexed 60/40 portfolio. (50/40/10 refers to a portfolio comprised 50% of Dynamic Asset Allocation, 40% Fund Upgrading — using a 60/40 stock/bond split in this case, and 10% Sector Rotation — see Higher Returns with Less Risk, Re-Examined.)

Table 2 shows how this dampening of volatility and loss has continued since the bear market rally ended in mid-August. The SMI active strategies have again significantly reduced losses relative to the market indexes. While both Stock and Bond Upgrading have held losses firmly in check all year, Table 2 shows how DAA’s performance has improved considerably relative to the market since the changes it implemented this summer.

We don’t present these numbers to pump our own tires. Understanding how protective SMI’s strategies are at present is critical to having the confidence to stick with them through the worst part of the bear market, which could still be ahead. Our current holdings are well positioned to help us ride out any further losses while putting us in a position to take advantage of significantly reduced prices once this bear market ends.

Where we’re going.

The point of shifting to cash and otherwise adopting such a conservative portfolio allocation is to preserve as much of our capital as possible so as to be in position to take maximum advantage of the bargains that always present themselves at the end of bear markets!

SMI’s strategies know how to make money in new bull markets. Consider 2003 and 2009, the years immediately following the past two big bears. In 2003, the market (Wilshire 5000) snapped back with a gain of +31.6%. Stock Upgrading blew past that, soaring +46.6%, while SR was even more impressive at +54.4%! Returns weren’t quite as dramatic in 2009, but both Stock Upgrading and SR exceeded the market’s heady gain of +29.4% in 2009.

This illustrates the value of preserving our capital now, so as to fully exploit the opportunities that will present themselves eventually. Every month that this bear market continues and the broad markets fall more than the SMI strategies is a direct boost to our eventual total return. We don’t get to see those gains on our statements...yet. But make no mistake, we’re earning those future outsized returns today when our portfolios register much smaller losses than the market.

Famous investor Shelby Davis once said, “You make most of your money in a bear market, you just don’t realize it at the time.” That’s what we’re doing by staying the course, keeping our losses tight, and waiting for our strategies to signal it’s time to redeploy our capital back into the markets. We’re not there yet, but it’s coming. Keep the faith and stick with the system.