The first half of 2022 generated many “worst since...” statistics, as both stocks and bonds suffered their worst start in many years. Compounding the pain for most investors was the fact that bonds, relied upon to provide ballast within balanced portfolios, fell sharply as interest rate expectations accelerated rapidly higher. Some measures indicate that bonds are having their worst year in U.S. history, dating all the way back to the birth of the Republic!

As SMI suggested in our January 2022 cover article, high and persistent inflation has pushed the Fed to tighten financial conditions, despite concerns about slowing economic growth. A traditional 60% stock/40% bond portfolio lost –16.1% in the first half of 2022, the worst performance for such a portfolio in the past 47 years (as far back as reliable bond index data exists). The prior worst first half for such a 60/40 portfolio was –6.7% in 2008, which offers a sense of how much worse this year has been for most investors than anything they’ve experienced before.

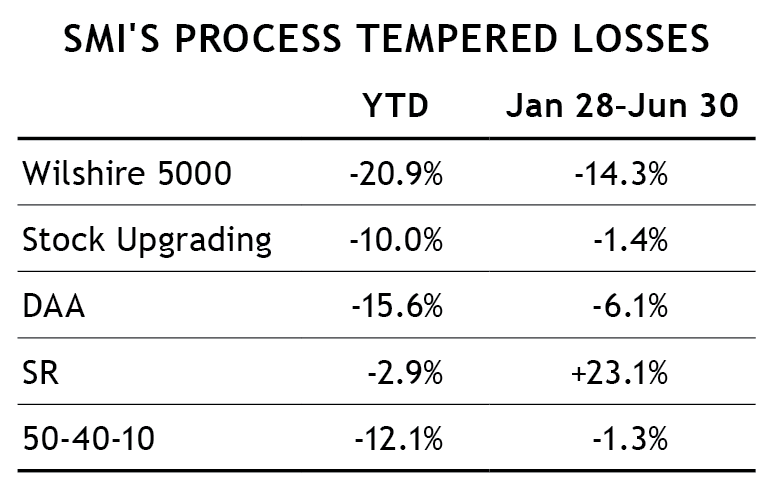

Thankfully, SMI investors have had a very different experience. As the Year-to-Date column of the nearby table shows, each of the SMI strategies has reduced losses considerably relative to the market during 2022’s first half.

But even more importantly, consider the second column of the table. This column shows how each strategy has performed since Jan. 27, the date when the first defensive adjustments were made to the SMI strategies.

The S&P 500 index didn’t peak until Jan. 4, which meant that the SMI strategies began 2022 in a relatively aggressive posture. Since making those first adjustments toward the end of January, SMI investors have had a radically different experience than most other investors. As the table shows, a 50-40-10 blend of SMI strategies lost roughly one-tenth that of the broad market after that point!

That’s not to say SMI investors will be immune to any further losses from this bear market. For example, in June/July, our positions in commodities and energy stocks — which had excelled most of the year — finally broke down, causing losses (or at least eating into previous gains).

But these returns clearly illustrate that the SMI process has been working through the first six months of this bear market. Given the vast improvement relative to the broad market since the defensive adjustments started kicking in at the end of January, there’s every reason to believe SMI investors will continue to outperform for the duration of this bear market.

A brief overview of each of the strategies follows below. But we’d like to also direct your attention to bit.ly/SMI-mid-year-video where a more detailed video presentation is available.

Just-the-Basics (JtB) & Stock Upgrading

As tough as the first half was for the S&P 500 index, which is dominated by the performance of the largest stocks, it was even worse for small stocks and technology stocks. The S&P 500 index lost –20.0% during the first half of 2022, while the Russell 2000 (small companies) fell –23.4% and the Nasdaq (tech) fell –29.5%.

The Year-to-Date (through 6/30) return for Just-the-Basics (–22.8%) does not reflect the defensive adjustments to cash that Stock Upgrading investors made through the first half of 2022. That’s the primary reason why the gap in returns is so large (–22.8% vs. –10.0%). Other factors included Stock Upgrading’s ability to pivot out of growth stocks at the end of January as well as its 10% allocation to commodities, which gained +28.3%during the first half of the year while stocks were falling sharply.

As is often the case, it wasn’t one thing that caused Stock Upgrading to hold up so much better than the broad market during the year’s first half, it was a combination of factors. Diversifying into commodities, pivoting to value stocks and away from growth, and ultimately shifting gradually into cash all played a role in Upgrading’s outperformance.

Bond Upgrading

As it became increasingly clear that last year’s “transitory inflation” narrative was false, the Fed found itself way behind the eight ball in terms of raising interest rates. While the Fed wouldn’t announce its first hike until March, the bond market started pricing in higher rates much sooner. The 10-year Treasury bond, which started 2022 at 1.63%, rose as high as 3.49% by mid-June. The rate of increase was even more dramatic with short-term interest rates, as the 6-month Treasury Bill leaped from 0.22% to 2.51% during the first half of the year.

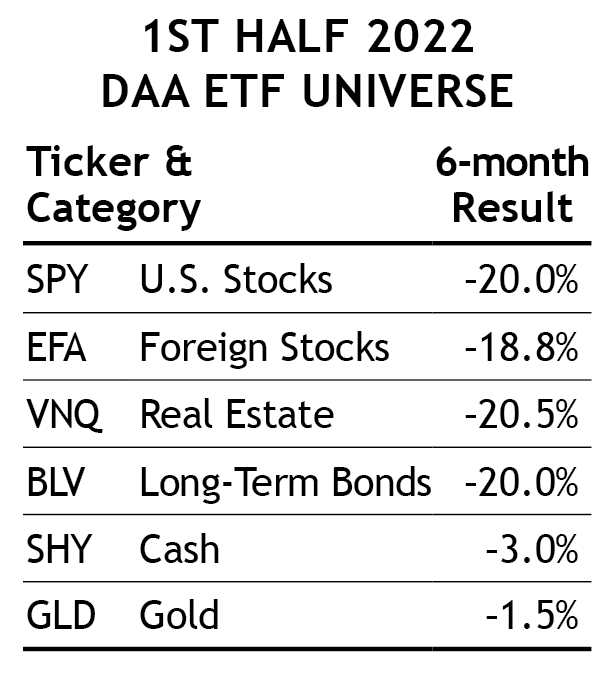

Bond Investing 101 says that when interest rates rise, bond values fall. And fall they did, as the Bloomberg U.S. Aggregate Bond index lost –10.35% during the first half of the year. As is typically the case, longer-term bonds fell even more, roughly -20%, which was as bad as the S&P 500 index!

Thankfully, Bond Upgrading had SMI investors positioned largely in short-term bonds throughout the first half of the year. Our main Upgrading recommendation, Vanguard Short-Term Inflation-Protected Bond (VTIP) drastically reduced our losses, falling only –1.5%. Overall, Bond Upgrading declined –4.6%, which wasn’t fun but was less than half the loss of the broad bond market.

Dynamic Asset Allocation (DAA)

The historically bad performance of bonds meant that DAA wasn’t able to pivot as quickly out of other riskier asset classes as would normally be the case. That was a significant factor in DAA’s performance lagging both Upgrading and Sector Rotation during the first half of 2022 (although, at -15.6%, it still outperformed the broad stock market overall and fell less than half as much as stocks after adjusting its allocations at the end of January).

DAA finally reached its most conservative posture in mid-June, which contributed to it beating Upgrading and SR for the month. That’s more familiar ground for DAA during bear markets and we expect that to be more representative of DAA performance through the rest of this bear market.

Sector Rotation (SR)

While DAA didn’t hold up as well as we would have expected through the first phase of this bear market, SR held up much better than we would have thought. After pivoting to energy stocks at the end of January, SR was the star of the show (along with Stock Upgrading’s commodities position)

While energy stocks corrected sharply during the latter part of June, the fact that SR ran so far ahead of the broad market and was only down -2.9% overall during the first half of the year was a huge boost to SMI portfolios.

50/40/10

This portfolio refers to the specific blend of SMI strategies — 50% DAA, 40% Upgrading, 10% Sector Rotation — discussed in our April 2018 cover article, Higher Returns With Less Risk, Re-Examined. It’s a great example of the type of diversified portfolio we encourage most SMI readers to consider. (Be aware that blending multiple strategies adds complexity. Some SMI members may prefer an automated approach. See bit.ly/SMIPrivateClient.)

The "Tempered Losses" table tells the story for this blended portfolio of SMI strategies. Its ability to pivot from an aggressive portfolio allocation at the start of the year to an increasingly defensive one helped limit losses significantly, and nearly shut losses down entirely after the strategies began adjusting to the new market regime at the end of January. All three strategies played an important role in that performance: SR was especially strong during February-May while DAA was weaker than we would normally expect. Then DAA stepped up in June while SR corrected.

That’s the essence of diversification — finding portfolio components that zig and zag out of sync with each other to smooth the path of the overall portfolio’s performance.

Conclusion

The “buy every dip” bullish mentality that became so firmly entrenched over the past dozen years is proving difficult to displace, which has led to a number of sharp bear market rallies already. As this is being written in mid-July, another rally is underway. It’s already the fifth bounce for the tech-heavy Nasdaq index that has approached (or exceeded) +10% in this brief bear market. There were 15 such Nasdaq bounces of +10% or more in the 2000-2002 bear market, during which the Nasdaq index fell –80% overall!

While investors continue to get whipped around by this back-and-forth market action, SMI investors can relax knowing they are following a process that will keep them aligned with the dominant market trend.

The three most important factors as we head into the second half of 2022 are as follows:

The dominant market trend is still clearly down.

Financial conditions continue to tighten, both via interest rate hikes and the Fed’s monthly Quantitative Tightening operations.

The global economy has started to slow significantly.

All three of these factors are distinctly negative for asset prices. For these reasons, we continue to believe that emphasizing wealth preservation is the most appropriate focus at this point in the market cycle. When the Fed pivots from tightening financial conditions to easing them again, we’ll shift our posture. But with inflation still well above the Fed’s target rate of 2%, that pivot is likely some distance away, justifying our continued defensive positioning.