The United States of America remains the center of the investing universe, but trends set in motion long ago seem certain to diminish its prominence in the decades ahead. As the 21st century unfolds, other nations and regions will become increasingly attractive to investors, bolstered by favorable demographics, rapidly expanding middle classes, and the globalization of financial markets.

This primer is intended to help SMI readers gain a general understanding of the broadening investing landscape.

The economy of the United States remains the largest and strongest in the world. The U.S. is blessed with abundant natural resources, relative political stability, a large and educated workforce, and a strong culture of entrepreneurship. Indeed, these are the primary elements that helped make the 20th century the American century. No nation has ever dominated the world’s economic landscape as the U.S. has for the past 100 years.

But in the 21st century, American dominance — though still a reality — likely will wane as the economic and investing landscape shifts. Consider this: As of mid-2017, the total value of almost all of the stock shares in the world — i.e., “global market capitalization” — was about $41 trillion, according to the research firm MSCI. U.S.-based stocks represented a bit less than 53% of that amount. In 2000, U.S. stocks represented more than 60% of market cap.

Granted, the United States remains far ahead of any other individual country, with the overall value of U.S. shares still nearly seven times greater than the total share value of any other nation. (Japan is in a distant second place, and the U.K. comes in third. Note that these rankings can change considerably depending on the data source — some sources already calculate China with the second-largest total.)

To be clear, this article is not about the U.S. being in decline. Rather, it’s simply to point out that earnings opportunities increasingly are cropping up in places other than in America (or Japan and Europe, for that matter). Stock shares in so-called "emerging markets" — including India, Mexico, South Korea, and Brazil — now account for more than 10% of global stock value. And in June, MSCI made financial headlines by announcing it will add 222 Chinese big-cap stocks to its Emerging Markets Index next year.

It’s a safe bet that most Americans have nowhere near 10% of their stock portfolios invested in emerging markets. Their home bias means they’re potentially missing opportunities.

Although technological advances have made investing overseas easier than ever before, international investing isn’t as straightforward as investing domestically. International investing requires you to deal with currency fluctuations, differing accounting procedures (that may make accurate evaluation more difficult), and foreign stock exchanges with different — usually more lax — regulations than those we’re accustomed to in this country. Political instability and national security concerns also can be a problem. So why take on the additional risks and complexities of investing internationally?

Diversification + opportunity

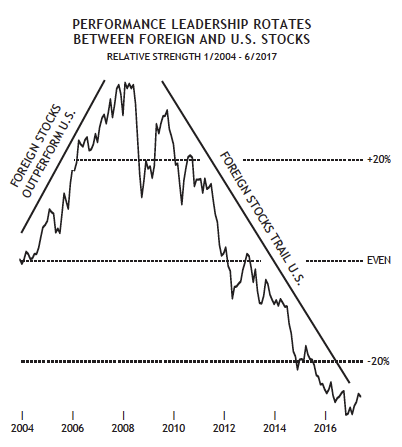

The conventional wisdom used to be that the primary reason for owning foreign stocks was to provide additional diversification. Ideally, when the U.S. stock market zigs, your foreign holdings would zag, offering more stability overall than a portfolio comprised solely of domestic stocks.

However, the degree of this diversification benefit has become a subject of debate in recent decades. For roughly 20 years starting in the 1990s, the performance of U.S. and non-U.S. stocks grew increasingly correlated. During this time, domestic and foreign markets were zigging and zagging together more than ever before.

However, the degree of this diversification benefit has become a subject of debate in recent decades. For roughly 20 years starting in the 1990s, the performance of U.S. and non-U.S. stocks grew increasingly correlated. During this time, domestic and foreign markets were zigging and zagging together more than ever before.

But just when it seemed time to write off the diversification benefit of owning foreign stocks, their correlation to U.S. stocks reversed and started moving in the other direction again. In fact, a July 2017 Charles Schwab research report noted the correlation between foreign stock markets “peaked in 2011 and has subsequently fallen in recent years to levels not seen since 1997.”

We’re hesitant to declare that this diversification benefit is back, given that we’ve yet to see a significant stock-market downturn since this recent trend change. It would make sense for foreign markets to provide less diversification benefit than they used to, given that the world economy, even as it becomes less U.S.-centric, is becoming more interconnected. At the same time, technological advances have lowered or removed barriers that used to restrict the flow of money across national boundaries.

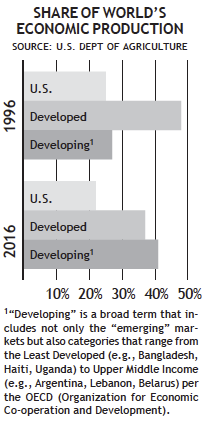

But regardless of whether the diversification benefit of owning foreign stocks has been decreasing, adding foreign holdings to your portfolio offers another benefit: foreign stocks offer broader growth opportunities than investing exclusively in U.S. companies. After all, as large and strong as the U.S. economy may be, America’s GDP represents only about one-fourth of worldwide economic activity. And as the chart above shows, while the U.S. has roughly held its own over the past 20 years, the rest of the world’s developed economies, such as those in Western Europe and Japan, have been losing ground to the developing world and the so-called emerging-markets countries. More on the investment opportunities to be found there shortly.

Fluctuating dollar implications

In the past, we’ve noted that investing internationally offers the potential benefits of protecting against both rising U.S. inflation and a weakening U.S. dollar. However, if the past decade has taught us anything, it’s that inflation and currency strength trends are as difficult to predict as everything else in the financial markets. Many expected the U.S. dollar to collapse and inflation to soar in the wake of the Federal Reserve’s unprecedented Quantitative Easing policies several years ago. Now, with the benefit of a decade’s experience observing the world’s central banks do everything in their power to stimulate inflation without success, it seems that runaway inflation is a misplaced fear. That said, investments in emerging markets could help you avoid losing financial ground if inflation were to pick up again at some point here in America.

As for the dollar, far from collapsing, it strengthened dramatically from 2009-2015, rising in value by roughly one-third. More recently, while most pundits expected a Trump presidency and Federal Reserve rate hikes to further strengthen the dollar, once again its direction has caught everyone off balance. The dollar has slid approximately 7% so far in 2017, despite three rate increases since last December. A weaker dollar is a net negative with respect to overall U.S. economic strength, but it tends to boost the profitability of an investor’s foreign holdings, which we’ve clearly seen this year.

Here’s a brief example we’ve used before to explain why that is: Let’s say that on Nov. 1, 2008, you invested $1,000 in the German stock market. First, your U.S. money was converted to euros. On the day you made your purchase, one euro could be exchanged for about $1.27 in U.S. money — or, stated another way, one U.S. dollar was worth .785 euros. So your $1,000 became 785 euros that were then invested in German stocks on the Frankfurt stock exchange.

After a year passed, you were able to sell your German holdings for 926 euros — a tidy 18% profit. After the sale, you converted your euros back into dollars. Fortunately (for you), the euro had gained against the dollar over those 12 months — a euro was then worth about $1.49 rather than $1.27. That means your 926 euros converted to $1,380.

Rather than enjoying an 18% profit, you actually gained 38%! You not only made money on the growth of your German investments, you more than doubled your earnings because of the relative weakness of the dollar during the span you were invested.

So, as you can see, a 20% increase in the value of the euro against the U.S. dollar makes the same profit contribution to an American investor with holdings in German stocks as if the German market itself had risen 20%.

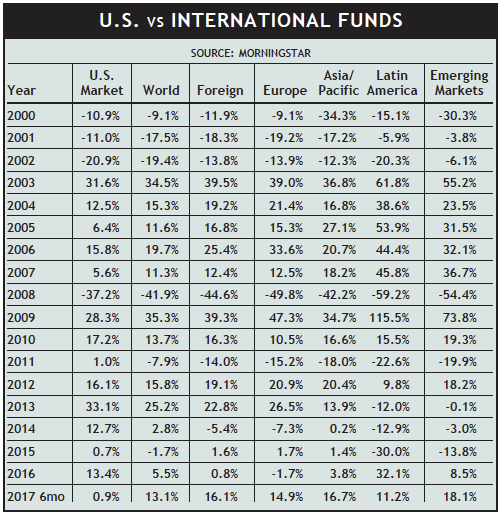

Understanding this currency dynamic makes it easier to see how the unusually poor returns of foreign investments from 2010-2015 were driven, in part, by the rising value of the dollar. In contrast, as the dollar has declined in value so far this year, foreign stocks have outperformed U.S. stocks. Currency fluctuations certainly aren’t the only factor, but they tend to provide either a headwind or tailwind to foreign stock performance.

Getting your money out there

Mutual-fund investors have four main types of international funds from which to choose (we list each type separately in our monthly Fund Performance Rankings — available online to SMI members):

World funds have the greatest latitude — they can invest around the globe, anywhere they find attractive opportunities. This means that many of these funds actually have substantial U.S. holdings. So if you invest in a world fund, you can’t be sure how much of your money will end up abroad. Since our Stock Upgrading portfolios suggest allocating a particular percentage of money toward international investing, we don’t recommend world funds for this purpose, as they may have heavy U.S. holdings.

Foreign funds, which make up Risk Category 5 for SMI Stock Upgraders, invest almost exclusively outside the U.S. Normally, these funds are the place to look if you want to invest across a number of countries through a single fund. (It’s up to each fund whether to set limits on how large a percentage of assets can be invested in any single nation or region.) With a foreign fund, you don’t have to call the shots about which countries and companies to invest in. Instead, you rely on the expertise of a fund manager who makes decisions about the most promising areas of the world, outside the U.S., at any given time.

SMI’s Dynamic Asset Allocation strategy uses an exchange-traded foreign fund (ETF) with the ticker symbol EFA for its international stock exposure. EFA is an index fund, designed to track the well-known MSCI EAFE index (Europe, Australasia and Far East). The EAFE index covers 21 developed markets outside North America, but does not provide exposure to the so-called emerging markets, discussed below.Regional funds, as the name suggests, narrow the geographical focus even more by investing in a particular region of the world (Europe, Asia, Latin America) or even a specific country (China, Japan, Canada). As such, regional funds tend to have greater volatility than funds with more geographically diversified holdings.

(Click Table to Enlarge)

Emerging markets: a growing power on the world economic stage

The fourth type of international fund concentrates its investing in “emerging markets.” Although the term doesn’t have a strict definition, it generally refers to 20+ nations in various parts of the world that are experiencing significant levels of economic development and reform. Most emerging-markets funds tend to focus on countries in Asia and Latin America rather than on emerging markets in the Middle East, Africa, and Europe (although this is slowly changing and is likely to change further as Africa’s demographics point to increased growth in a decade or two).

The huge populations and growth potential of China and India make them the center of any emerging markets discussion. Brazil and Russia are the next two largest. The other emerging markets of the Asia Pacific region are Indonesia, Malaysia, Pakistan, South Korea, Taiwan, Thailand, and the Philippines; in Latin America, emerging markets include Chile, Colombia, Mexico, and Peru. Other countries that are often included in the emerging markets category include the Czech Republic, Greece, Hungary, Poland, Turkey, Egypt, Qatar, United Arab Emirates, and South Africa.

Because emerging markets are coming from a relatively low base of development in comparison with advanced economies, they hold significant growth potential. That said, emerging markets haven’t exactly been stellar performers in recent years, although now things seem to be turning around. Overall economic growth in emerging markets began ramping up last year and has now “leveled off at around 4%,” according to a June report from the research company Capital Economics. To be sure, some of the growth is driven by commodity exports, but much of it is propelled from within, as these nations develop infrastructure, improve education, and foster a growing middle class.

In a world where the developed nations — including the U.S. — are struggling to reach 2% GDP growth, the 4% or more offered by emerging markets is extremely attractive. While emerging markets may make up a relatively modest share of overall global activity, they represent a huge portion of the world’s potential economic growth.

Even though emerging markets offer tantalizing potential, they tend to be characterized by significant volatility, driven by large money flows that come and go. Most emerging markets have a relatively small investor base within the country itself, so they simply aren’t large enough to take it in stride when huge sums of money from outside investors suddenly pour into the country in search of profit opportunities — and then often retreat just as quickly. In addition to volatility issues, emerging markets are also more subject to regulatory and accounting risk than established markets.

Still, the investment potential of these markets needs to be weighed not only against the inherent risks, but also against what some observers think could be years of sluggish growth elsewhere. This is where demographics paint a grim picture for developed markets and a bright one for these emerging markets. America is in better shape demographically than many developed markets (such as Japan and much of Europe), but even here we face massive headwinds given our current debt levels and rapidly aging population. Every day roughly 10,000 Americans turn 65. We know that 65-85-year-olds don’t spend as much as younger people do.

Contrast the U.S. situation with that of India and other emerging markets where the labor force is young, deep and relatively cheap. Economic growth can be boiled down to two factors: growth in working-age population and growth in labor force productivity. The U.S. labor participation rate, and by extension the amount we consume, is in decline. India’s is ramping up. Given these economic realities, it’s not difficult to conclude that a large portion of global growth will be shifting away from the United States and other developed countries and toward the emerging markets.

Boosting your international exposure

A recent CNBC report noted that the average mutual fund investor in the U.S. has about 15% of their equity holdings in international stocks. We suspect most SMI readers are above that mark since SMI’s basic strategies call for equity allocations of at least 20% to foreign holdings. It’s worth noting that some investment professionals recommend even higher levels. Charles Schwab, the founder of the discount broker and mutual-fund firm that bears his name, has urged American investors to be bolder in their allocations to foreign investments. “If you’d asked me 20 years ago, I’d say you needed 15% in international investments,” he once told Barron’s. “I’d say now it’s closer to 40%.”

For now, we’re comfortable with our current SMI recommendations, though it’s certainly possible we might increase our foreign allocations in the future if we see these trends translating into superior foreign stock performance. This likely wouldn’t be in response to short-term fluctuations such as the valuation of the dollar, but rather the longer-term trends we’ve been discussing.

It’s worth noting that Stock Upgraders often have a few percentage points of “hidden” international exposure in their portfolios. This tends to increase as foreign markets excel for extended periods of time and domestic managers are increasingly lured by overseas opportunities. For example, a Morningstar X-Ray of the SMI Stock Upgrading holdings currently shows a 21% allocation to international stocks rather than our 20% target. Why is that?

The answer is simply that many domestic stock funds own a handful of international stocks. But several years ago, when foreign stocks were holding an extended performance edge (and thus were more attractive to U.S. fund managers), that “hidden foreign exposure” amounted to an additional 4% of a Stock Upgrading portfolio.

SMI members who use the Dynamic Asset Allocation strategy have another means of significant foreign stock exposure. DAA allocates a full third of its portfolio to Foreign Stocks when its model shows them to be among the top-performing asset classes. As a result, an SMI member with a 50/40/10 type portfolio might have as much as 25% of their total portfolio in foreign stocks when Foreign Stocks are among DAA’s recommended holdings.

For those who wish to increase their international holdings further, there are a few easy ways to do so. The first is simply to boost your holdings in the international funds recommended for Upgraders on page 122. Given that the other four (domestic) risk categories are evenly weighted in Stock Upgrading, it’s a simple task to divert money evenly from the other four categories to accomplish this. For example, an Upgrader might decide to drop each of the other risk categories from 20% to 18%, and boost the foreign fund allocation to 28%.

Because most of the foreign funds used in Stock Upgrading tend to focus primarily on developed markets, and the foreign ETF used in DAA focuses exclusively on those markets, another option would be to supplement your international holdings with a dedicated Emerging Markets fund from SMI’s monthly Fund Performance Rankings. The iShares MSCI Emerging Markets ETF (EEM) is another good choice to accomplish this goal. Adding an Emerging Markets holding is a higher risk/reward approach when compared to simply boosting the foreign allocation of a standard Upgrading portfolio.

For most SMI readers though, there’s no need to make portfolio adjustments based on this article. Rather, our intent is simply to help you understand the lay of the land when it comes to international investing. Foreign stocks look attractive relative to U.S. stocks right now based on their better growth prospects and cheaper valuations. But while foreign stocks have outperformed so far this year, U.S. stocks had led for several years and it’s too early to conclude that dynamic has changed.

The trends described in this article are likely to gradually shift the balance of power over the coming decades, but the U.S. is starting from such a dominant position that its strength is unlikely to recede rapidly. That’s why we think the 20-25% total allocations to foreign stocks that most SMI investors likely have is sufficient at present.