If you have a diversified investment portfolio, you’ll almost always be unhappy with at least some portion of your holdings.

We published a newsletter article about this in 2017 titled, Diversification Means Always Having to Say You’re Sorry — and Why You Should Do It Anyway. Author Daniel Crosby wrote:

Investing broadly is as much about managing fear and uncertainty as it is concerned with making money. At its essence, diversification is applied humility in the face of an uncertain future.

I think of diversification much the same way that insurers think of providing coverage. Just as some insured folks will have accidents that trigger a payout every year, many more will not. Insurance companies make money because their risk is diversified across the corpus of those paying premiums. Similarly, when you are diversified between and within asset classes, the failure of one single type of investment does not dramatically diminish your odds of long-term success.

Frankly, diversification often can make us "feel" like we missed the boat. "Wow, look at (insert hot stock here)! If only I had invested a lot of money in that!" But suppose that hot-stock "boat" had sunk and a sizeable portion of your portfolio had gone down with it?

I’ll extend the metaphor. Diversification doesn’t protect you from all shipwrecks. Instead, it provides you with a large fleet. You might suffer a foundering or disablement here and there, but most of your fleet will sail on.

Steady as she goes

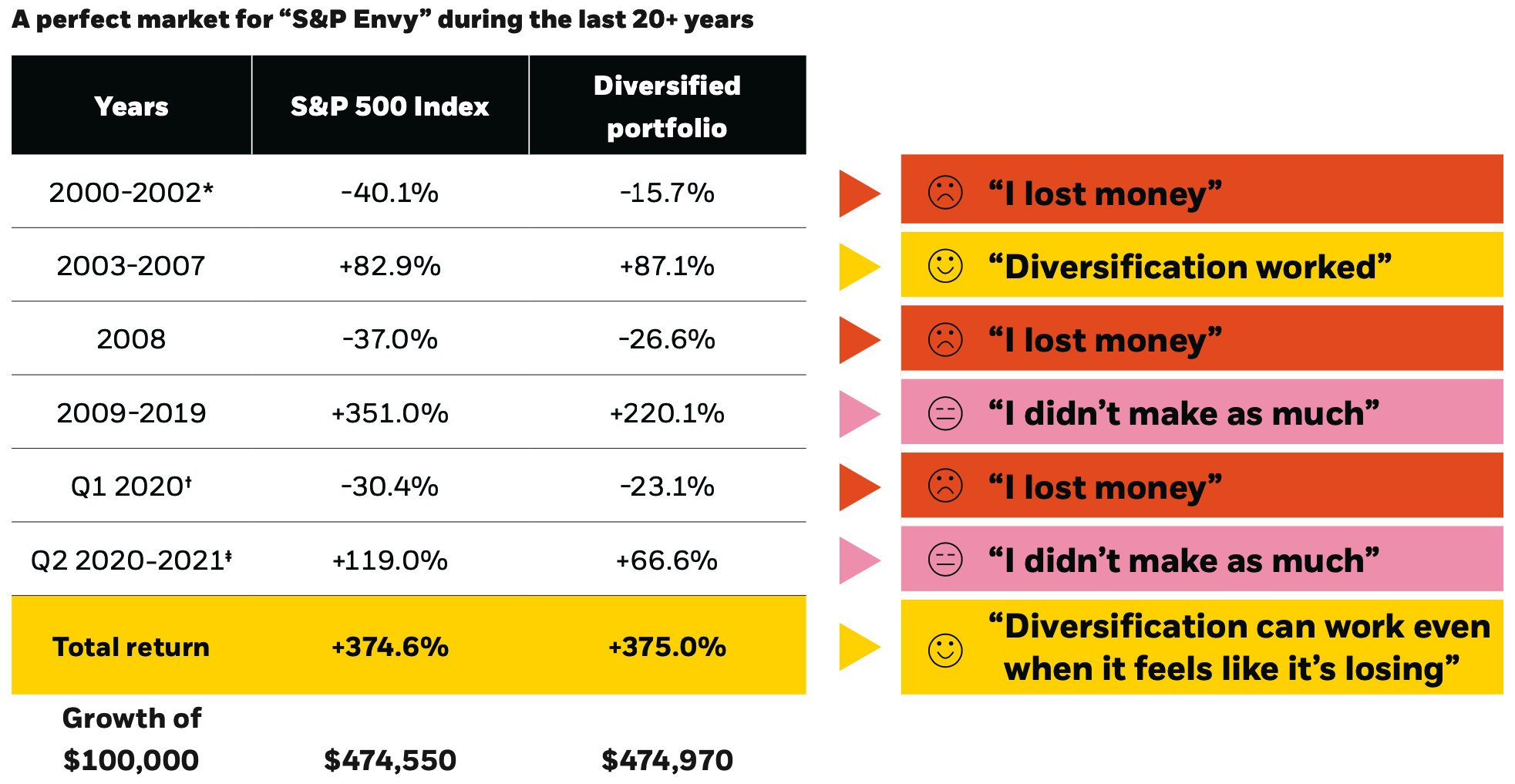

Here’s a graphic from BlackRock that captures the emotional phases of being diversified. The graphic compares the performance of a diversified portfolio (large companies, mid-caps, small companies, foreign stocks, bonds) to the S&P 500 (large companies only) over the past 20-plus years.

Click to Enlarge

Note that much of the time (see the specific time frames above), diversification wasn’t emotionally satisfying. And yet the end result — solid returns with less risk —was satisfying indeed.

Here’s one more quote from the Diversification Means Always Having to Say You’re Sorry article:

Owning a diverse basket of assets or stocks is a certain recipe for disappointment if you take too narrow a view. There will always be laggards and your mind will generate an endless stream of "if only" scenarios that would have been superior to humble diversification. But considered as a whole portfolio over long periods of time, the power of diversification is so profound that...it [is] "the only free lunch in investing."

Diversification may mean always having to say you’re sorry, but it’s far better than what you’ll be saying if you don’t diversify.