As we have noted in previous articles and posts, growth stocks (on the whole) have been outperforming value stocks for more than a decade.

(Definitions of "growth" and "value" are imprecise but, generally speaking, growth stocks are those that seem poised for onging earnings growth so investors are willing to pay higher prices for them, while value stocks are those that may be underpriced and therefore stand to benefit when the market ultimately corrects the price, which may take many years.)

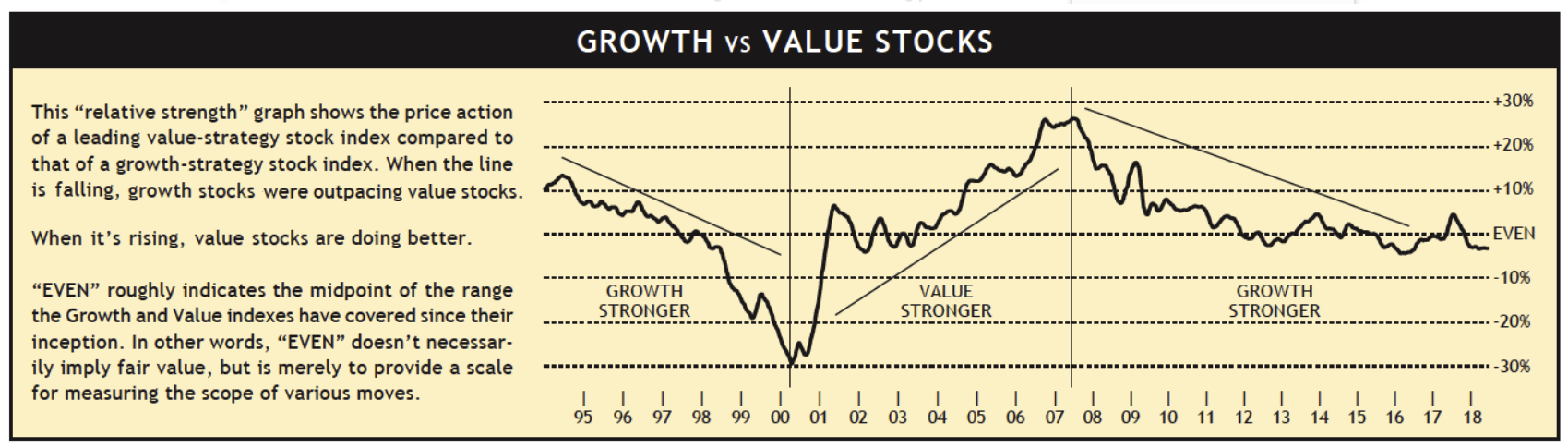

But things can change. Indeed, leadership between growth and value tends to (slowly) swing back and forth, as we explained in our June 2018 issue:

[A] striking example of growth-fund dominance occurred in the late 1990s, when the "tech bubble" focused investor imaginations on an increasingly narrow number of high growth stocks to the utter exclusion of anything value-oriented. As you can see [from the chart below], however, investor appetites shifted quickly once the bubble popped. Value stocks dominated through the early 2000s.

Click Graphic to Enlarge

Some investors have noted parallels between the late 1990s and today’s market. While similarities such as the current market’s fascination with the “FAANG” big tech stocks exist, it’s not a perfect comparison. For one thing, growth-stock valuations aren’t nearly as high today as they were then, and on the flip side, value isn’t nearly as inexpensive. But it’s certainly possible that a shift in the growth/value dynamic could be coming.

But in its September 16 issue, Barron’s features three articles that call attention to early evidence that a growth-to-value rotation may be at hand. From "The Dow’s 1.6% Gain Hid Turmoil Beneath the Market’s Surface":

The Dow Jones Industrial Average [last week] gained 422.06 points, or 1.6%, to 27,219.52; the S&P 500 index rose 1%, to 3007.39; and the Nasdaq Composite advanced 0.9%, to 8176.71.

But those numbers entirely miss the point.

It was a week when everything that had been working stopped working, when losers were suddenly winners. Value stocks, the market’s cheapest, had underperformed growth stocks by 14 percentage points since the start of 2018....

This past week, value gained 2.4%, while growth dropped 0.5%.... It was as if the meek had inherited the market.

Another Barron’s piece has this:

The big question for investors, of course, is whether this shift will continue.... [The Investment banking company UBS notes that if] history is a guide, a recent slowdown in manufacturing signals that growth stocks will now begin to underperform defensive ones.... It favors staples, health care, utilities, and real estate investment trusts.

Steady as she goes

Twists and turns are par for the course in investing. But no one knows exactly when changes will occur — or what they will look like when they do occur.

This is one reason SMI recommends diversified portfolios. Our Upgrading strategy, for example, has always included both growth and value investments (as well as both large and small companies). As the growth portion of a portfolio zigs, the value portion can zag, and vice versa. That helps smooth volatility — and anxiety — along the way.

So while a growth-to-value rotation may be underway (the jury is still out — more than one strong week from value will be required), such a shift would not mean any change of plan is necessary. Whether growth is in vogue or value is, whether big companies are in favor or investors are looking to smaller companies, Upgrading will follow the trends and, using a diversified approach, find the mutual funds that are the best performers. To be clear, if such a shift is taking hold, we will see it reflected in the normal Upgrading process that moves us out of "growthier" funds and into more "valuation" focused alternatives.

It is also worth noting that over long periods of time (30-to-40 years), the cumulative performance difference between growth and value investments has been quite small. In other words, both styles generate similar returns over time, but they get there differently.

So while the news of a possible comeback for value stocks is interesting, all you really need to know is "steady as she goes." Keep following the normal strategy signals — those will help us reposition as conditions warrant.