Today is Fed Day, although perhaps we should be calling it "Central Bank Week," given that the European Central Bank meets tomorrow (with the expectation of more details regarding the timeline for the unwinding of its bond-buying program), and the Bank of Japan kicks off a two-day meeting tomorrow as well.

The expectation here at home is for another quarter-point increase to the Fed Funds interest rate to a range of 1.75%-2.00%. That would be the second increase of 2018, and the seventh overall for this tightening cycle. [UPDATE: That expectation turned out to be correct.]

SMI has long been on record that eventually it would be Fed rate hikes that bring an end to the current bull market. That may not seem like a particularly brilliant insight at this point, but it was a fairly bold idea when we first started trotting it out in 2012 or 2013, when there were any number of potential bear market catalysts for investors to fret over. Back then, it was intended as a comfort — that the current bull market was unlikely to end any time soon, because the Fed’s incredible low interest-rate accommodation was nowhere near over. But today, after seven interest rate hikes, that idea rightfully takes on a more ominous tone.

Monetary policy drives the end of most market cycles

Why have we focused so intently on monetary conditions — meaning Central Bank policy: the combination of interest rates and other monetary policy actions like "Quantitative Easing" — as the likely catalyst of the bull market’s end? Because if you look hard enough, it’s pretty easy to make the case that monetary policy is almost always the cause of recessions and bear markets (if not all bear markets, at least the really bad ones). Yes, there are often other factors involved and those "events" or specific circumstances may get the headline billing when a particular bull market postmortem is written. But whether at the forefront or lurking in the background, there’s usually also a Fed rate hike cycle involved.

Given the unprecedented response of the world’s central banks to the Great Recession a decade ago, it was hard to imagine anything other than monetary policy driving this particular bull/bear cycle. That has proven to be accurate, at least to this point.

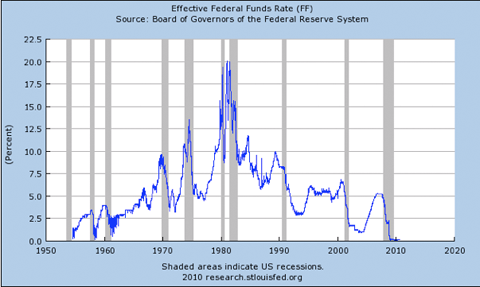

Here’s a chart illustrating the correlation between past rate hike cycles and U.S. recessions. Over the past 64 years, there have been nine recessions and all nine were preceded by a cycle of rate hikes. Granted, recessions aren’t synonymous with bear markets in stocks, and there other nuances involved with some of these past cycles. But given that the most severe bear markets are those that coincide with economic recessions, it’s pretty clear why we pay as much attention as we do to the Fed’s interest rate policies.

Driving that home a little more pointedly, here’s Deutsche Bank macro strategist Alan Ruskin’s explanation of how "every Fed tightening cycle creates a meaningful crisis somewhere, often external but usually with some domestic (U.S.) fallout."

Going back in history, the 2004-6 Fed tightening looked benign but the U.S. housing collapse set off contagion and a near collapse of the global financial system dwarfing all post-war crises. The late 1990s Fed stop/start tightening included the Asia crisis, LTCM and Russia collapse, and when tightening resumed, the pop of the equity bubble. The early 1993-4 tightening phase included bond market turmoil and the Mexican crisis.

The late 1980s tightening ushered along the S&L crisis. Greenspan’s first fumbled tightening in 1987 helped trigger Black Monday, before the Fed eased and ‘the Greenspan put’ took off in earnest. The early 80s included the LDC/Latam debt crisis and Conti Illinois collapse. The 1970s stagflation tightening was when the Fed was behind ‘the curve’ and where inflation masked a prolonged decline in real asset prices.

The bad news

So that’s why we’ve been treating the unwinding of the global central-bank policies of the past decade as a big deal. Couple that with current market valuations, which are very high by historical measures, and it’s quite a potential 1-2 punch.

Remember, market valuation tells us little about timing, but quite a lot about what type of total returns we can expect over the next decade or so. Generally speaking, the higher valuations are today, the worse we should expect overall market returns to be over the next decade. Knowing that valuations are high, when we see a massive monetary tightening cycle unfolding globally, the most likely path appears to lead to a significant bear market that would reset valuations at lower levels and bring total forward returns down significantly.

The good news

But that’s not the same thing as saying a bear market is imminent. This cycle has been particularly difficult to forecast (not that it’s ever easy) given that the system is loaded with never-seen-before inputs. Interest rates have never been taken to zero and left there for years. Central banks have never bought huge amounts of sovereign debt and then been faced with the task of selling it all back into the market. While some of the big-picture trends have made rough prognosticating possible — like our expectation 5-6 years ago that the bull wasn’t over because the scale of these stimulative monetary policies seemed to ensure the bull market would last longer than anyone expected — it has made more precise forecasting even more of a fool’s errand than it usually is (which is saying something!).

Historically, the stock market typically has started to decline about 6-9 months prior to an economic recession. But those market declines usually start out in relatively mild fashion. For example, stocks might decline 10-15%, then meander around for several months before the economic data start to get significantly worse. Ken Fisher has described a "two-thirds, one-third" rule regarding bear markets, meaning that two-thirds of the losses happen during the last one-third of its duration.

It’s that tendency for bear markets to develop slowly that gives SMI’s DAA and Upgrading 2.0 defensive protocols time to work and still protect us in a significant way over the course of a full bear market (while allowing us to stay invested right through the end of the prior bull market). History says there’s no need to rush to anticipate bear markets — they give us time to adapt after they’ve definitively begun.

The good news is that as of right now, there aren’t any significant signs of economic slowdown or recession anywhere on the horizon. Quite the opposite, in fact. The typical array of "leading indicators" that often signal economic trouble a year or so out are still in good shape. Now that doesn’t mean we can’t have a recession start in spite of these leading indicators. And as we just noted, stocks often start declining much sooner anyway. It just means that, in terms of what can be observed right now, there’s no reason to expect a recession or bear market to begin in the next several months.

But the really good news is that even if those signals are wrong, those investing using a diversified blend of SMI’s strategies should be protected anyway.

So we encourage you to do what we always encourage you to do. Have a long-term plan appropriate for your risk tolerance and season of life. Know what you’re going to do in response to the market turmoil that we consider to be inevitable, even if we can’t pinpoint when it’s coming. Then follow that plan!

Hopefully, unlike in the past, the defensive enhancements we’ve made over the past decade will allow most SMI investors to not change a thing in terms of their portfolios during the next bear market. That’s really the goal — that the strategies will respond themselves, so those following them can just continue to follow the normal signals and not have to make any "big picture" adjustments.

A note on SMI’s "momentum" approach to investing

Momentum investing, which is what we’re doing in the SMI strategies, often gets a bad rap late in bull markets. That’s because it typically pushes investors into the biggest gainers late in bull markets, only to have them get gored when those biggest gainers turn into the biggest losers in the subsequent bear market. But this critique overlooks a couple of important points, at least as applied to SMI’s approaches.

First, it brushes past the fact that the gains in the late stages of bull markets tend to be fantastic for momentum investors. SMI investors are experiencing that this year (as they did last year as well). But more importantly, while we know our portfolios will give back some of their gains when the transition from bull to bear finally does occur, the nature of bear market timing that we discussed earlier gives us confidence that we’ll be able to minimize enough of the bear’s losses to make it worthwhile to hang in now and capture the rest of the bull’s gains.

That’s why we don’t feel the need to guess when the bull will end exactly, because we don’t need to anticipate the end in order to get out in advance. As much as the defensive protocols are designed to save us from downside during the next bear market, their greatest value may be in giving us the confidence to stay invested now and keep harvesting these late-bull gains.

While we expect to look back eventually and attribute the end of the bull market to the actions of the world’s central banks, there’s little reason to believe that this week’s actions are going to be the tipping point. Our advice is to stay the course with an appropriate plan and trust your systems to protect you when the day finally arrives that you need protecting. For now, enjoy the market sunshine and strong returns! But don’t be fooled by them into taking on more risk. While late bull market returns always feel fantastic, today’s Fed meeting is a reminder that it won’t last forever.