After closing the second quarter with a brief June stumble, the stock market resumed its rapid climb in July and August. By September 2, the S&P 500 had set another new all-time high and was up a rather shocking +15.85% for the quarter. But as often happens after such a sharp move, the market quickly reversed course and flirted with a -10% correction over the next few weeks before trimming its losses to close out the quarter.

Despite the brief September swoon, overall it was a great quarter for stocks. The Wilshire 5000 index finished with a gain of +9.1%, while the tech-focused Nasdaq index gained +11.0%.

SMI investors enjoyed a strong quarter as well. Except for Sector Rotation, all of SMI’s strategies set new all-time highs during the third quarter. (SR narrowly missed a new high but still gained +17.2%!).

Just-the-Basics (JtB) & Stock Upgrading

The U.S. stock market was definitely the place to be invested in the third quarter of 2020. The two domestic-stock components of SMI’s JtB portfolio posted excellent returns (VFIAX +8.9%, VEXAX +9.9%), while its foreign element lagged a bit at +6.5%. Despite that, JtB finished the quarter up +9.0%, just a whisker behind the Wilshire 5000’s +9.1% gain (which has no foreign component).

Stock Upgrading also posted strong gains, finishing the quarter slightly ahead of the market with a gain of +9.2%. The fact that Stock Upgrading beat the market is particularly surprising given it started the quarter roughly two-thirds in cash and didn’t get fully reinvested in stock funds until August.

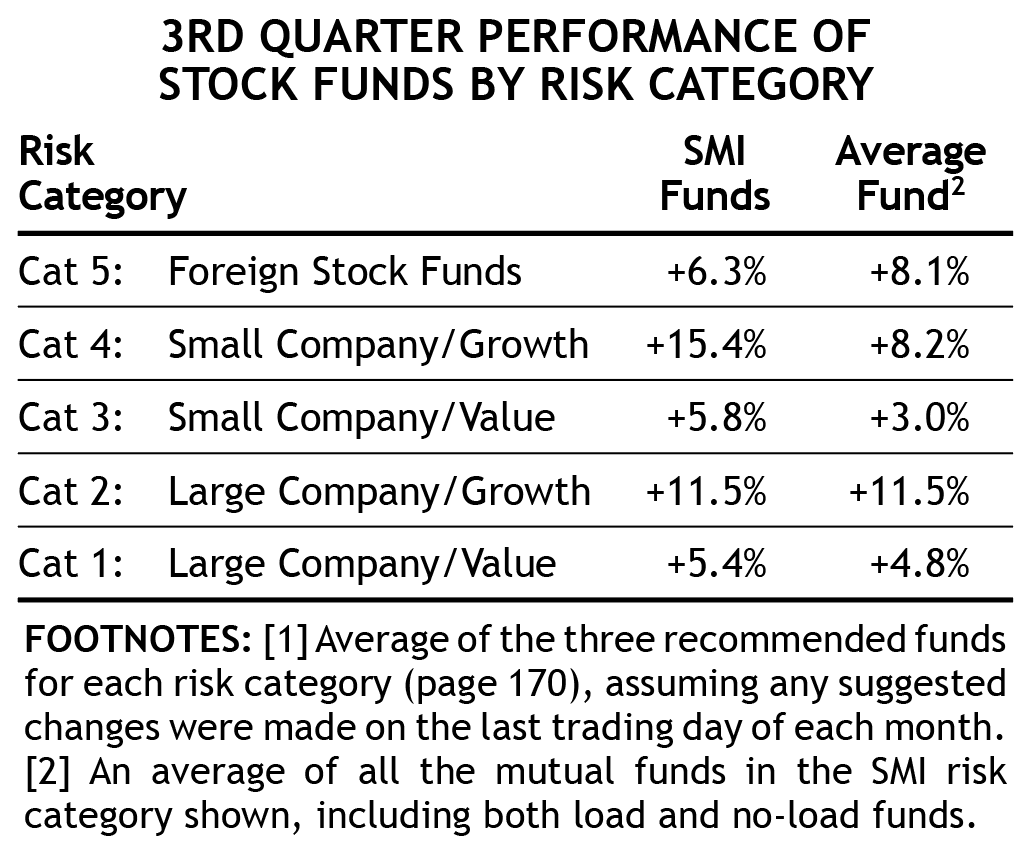

As the risk-category performance table shows, both growth categories were considerably stronger than the value and foreign categories during the third quarter. The only category where Upgrading lagged was Foreign, and that with a considerable July cash handicap. In all four domestic risk categories, our Upgrading holdings either matched or exceeded the returns of the average fund, despite the July cash drag.

Bond Upgrading

The idea of diversifying a portfolio among multiple asset classes is that when one holding struggles, another part of the portfolio excels. That dynamic has played out vividly between stocks and bonds in 2020: When stocks struggled early in the year, bond returns soared. We saw the flip side of this dynamic during the third quarter, with bonds largely flat as stocks soared.

Thankfully, Bond Upgrading provided better returns during the third quarter than the overall bond market did, continuing a trend we’ve enjoyed throughout 2020. Bond Upgrading gained +1.1% during the quarter while the Bloomberg Barclays U.S. Aggregate Bond index was up just +0.6%. Even though that +0.5% difference isn’t huge in absolute terms, it’s significant given today’s bond yields. Nearly doubling the index’s return in the third quarter also pushed Bond Upgrading’s year-to-date advantage over the index to +8.8% vs. +6.9%. That type of outperformance really moves the needle, particularly in more conservative portfolios, as we’ll explore further in the 50/40/10 section below.

Dynamic Asset Allocation (DAA)

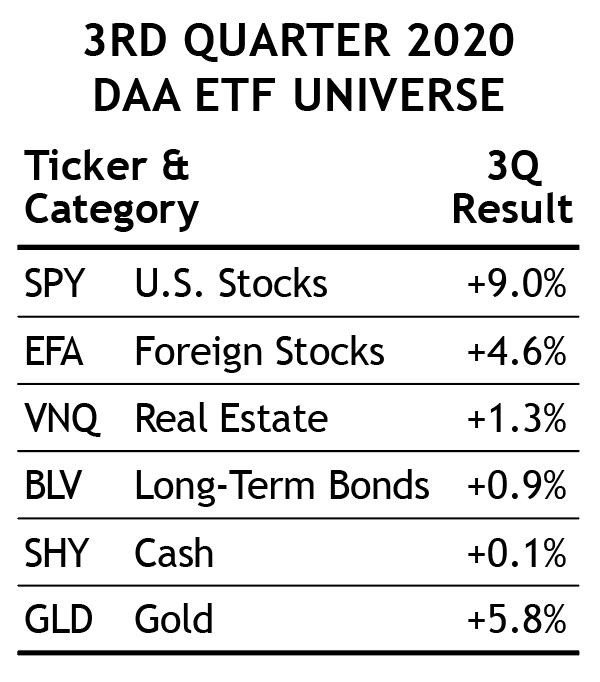

When U.S. Stocks outperform all other asset classes to the degree they did during the third quarter (see inset table at right), DAA typically can’t keep up, given that its maximum allocation to U.S. Stocks is one-third of the portfolio. But DAA still had a solid quarter, riding gains in U.S. Stocks and Gold — the two strongest classes of the six — while also getting a positive contribution from Bonds before selling them at the end of August. While DAA lagged Stock Upgrading and SR this quarter, it managed to gain enough to keep it at the top of the 2020 SMI leaderboard. (We’ve written quite a bit about gold in recent months — see the article links in the top right sidebar.)

Owning long-term bonds throughout most of 2020 was a great move, particularly given the sharp bear market in stocks in Feb-March. DAA’s bond holding (BLV) gained +8.2% between February-August. However, with yields having largely plateaued (at extremely low levels) following the Fed’s intervention this spring, bond momentum faded to the point where the system called for Bonds to be replaced this quarter.

Sector Rotation (SR)

Sector Rotation is known for big gains and losses. The third quarter was no exception to the rule. Thankfully this was one of the big “up” quarters, as SR cruised to a massive +17.2% gain.

Most of that came in August after SR shifted us out of Healthcare and into Technology. As is typically the case with these SR holdings, volatility was ever close at hand, and we saw the value of our SR holdings drop -14.7% in just four days to start September! Thankfully, our holding recovered most of that ground by the end of the month to finish with a modest monthly loss and a great overall gain for the quarter.

50/40/10

This portfolio refers to the specific blend of SMI strategies — 50% DAA, 40% Upgrading, 10% Sector Rotation — discussed in our April 2018 cover article, Higher Returns With Less Risk, Re-Examined. It’s a great example of the type of diversified portfolio we encourage most SMI readers to consider. As we’ve seen repeatedly in recent years, the markets can shift suddenly between rewarding risk-taking and punishing it, so a blend of higher-risk and lower-risk strategies helps smooth the long-term path and promotes the emotional stability that is so important to sustained investing success.

A 50/40/10 portfolio gained +7.3% during the third quarter, setting a new all-time high for this strategy. While that’s less than the Wilshire 5000 index’s quarterly gain of +9.1%, it’s worth digging into that comparison in more detail, given that most SMI members don’t have 100% stock portfolios.

SMI always reports the 50/40/10 portfolio returns based on the 40% Upgrading allocation being invested solely in Stock Upgrading. A 50/40/10 portfolio using that approach would have slightly lagged the Wilshire 5000 index through the first nine months of 2020: +5.5% vs. +4.4%.

But how does the comparison change when we use other “real world” stock/bond splits for the Upgrading portion? First, consider an investor who divided his portfolio evenly (50/50) between stocks and bonds. Such a split (as measured by the Wilshire 5000 stock index and Barclay’s Aggregate U.S. Bond Index) would have produced a +6.1% return through the first nine months of 2020. In contrast, a 50/40/10 investor who divided the Upgrading portion of his portfolio evenly between Stock and Bond Upgrading would have earned a bit more at +6.4%. (A 60/40 stock/bond split would have been similarly close: +6.4% for the indexed 60/40 portfolio vs. +6.0% for 50/40/10 using a 60/40 Stock/Bond-Upgrading mix.)

The point is that these real-world blended portfolios have done a good job for investors in spite of Upgrading 2.0 getting caught holding significant cash during the market rebound earlier this year. To be sure, that bear-market protection clearly cost SMI some upside, yet a diversified portfolio that included Bond Upgrading and DAA still posted returns competitive with fully-invested indexed portfolios. Obviously, that 2.0 scenario could have ended quite differently: Our portfolios had significant downside protection at a time when only massive government intervention kept stocks from likely experiencing a much deeper decline. If that intervention hadn’t come with unprecedented speed, we would likely be singing a much more upbeat song about Upgrading 2.0 right now.

Whether you’re using the “standard” 50/40/10 blend or a different combination, we think most SMI readers can benefit from blending these strategies in some fashion. As we’ve seen in 2020, such a blend has the ability to provide significant downside protection while still maintaining the upside potential to take advantage of strong bull markets. That’s a powerful combination!