At the rate the financial markets respond to new narrative themes these days, it’s no surprise the three-month span of the second quarter was plenty of time to take investor emotions from optimism to despair to glee.

The quarter began with “Goldilocks” expectations: an economy neither too hot nor too cold, and interest-rate expectations to match. The economy was widely thought to have cooled just enough to halt the Fed’s multi-year rate hiking campaign, but not so much as to threaten the economy with recession. This combination led to strong April stock returns, while bonds were largely flat.

The May pivot to recessionary expectations, based largely on the breakdown of trade talks between the U.S. and China, was rapid and the impact on financial asset prices was immediate: stocks tanked and bonds soared. But following the modern script that investors have become familiar with (and reliant on?), the Fed quickly responded to the market’s cry for help. Fear not, they reassured, rate cuts would be quickly forthcoming if the economy were to slow further. There’s nothing modern financial markets like better than Fed intervention and rate cuts, so that was just the ticket to turn May tears into June laughter.

The first half of 2019 was the strongest start to a year for stocks since 1997, and most other asset classes also experienced strong returns. Bonds, real estate, gold — it was a great first half for investors of nearly all stripes. SMI investors certainly benefited from these strong returns as well.

While the results of the first half were great, it’s a bit sobering to compare how much the economic backdrop shifted in just those six short months. In the last quarter of 2018, expectations for economic growth were strong and interest rates were rising as a result. Stocks ran into trouble when those growth expectations began to slow and the Fed didn’t immediately announce a pause in their rate hike plans.

By mid-year, the stock market had completely erased the 2018 correction with gains of nearly +20%. Yet recent measures of economic growth and future expectations have both shifted lower, and the market’s June surge required not only the prospect of holding interest rates steady, but the prospect of future rate cuts.

It’s hard to make an argument that the economy is in better shape than it was at the beginning of the year, despite the strong returns of financial assets. Eventually, this connection matters — the long-term direction of the stock market is driven by the health of the economy, although the two can move in opposite directions temporarily, as they have this year. That said, there’s also no reason that financial asset prices face an imminent decline, given current conditions.

Thankfully, SMI’s strategies don’t have to predict these twists and turns in order to succeed. We can continue to stay invested and enjoy the gains of the rising markets while they last, while still having reason to be optimistic that we can avoid some of the downside of an eventual bear market.

Just-the-Basics (JtB) & Stock Upgrading

Both JtB and Stock Upgrading posted solid second-quarter gains. JtB gained +3.4%, slightly less than the U.S. market (+4.0%), due to lower returns from its smaller and foreign stock components.

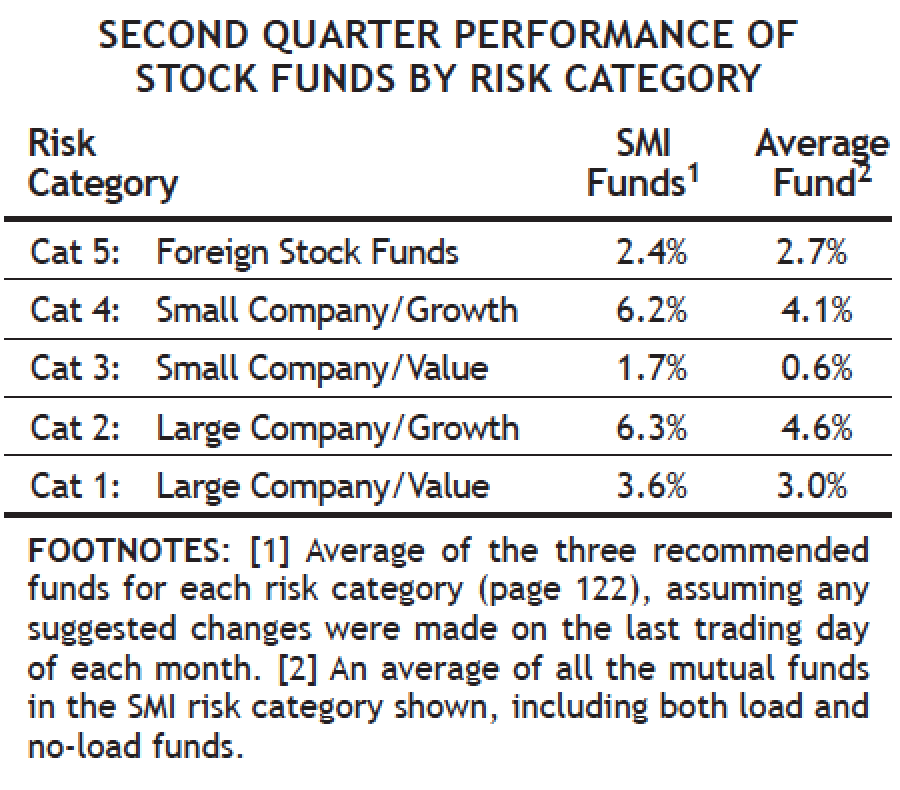

In contrast, strong returns from both growth risk categories helped Upgrading beat the overall market during the second quarter with a +4.1% gain. As the table shows, the Upgrading process added value in four of the five risk categories during the quarter.

While the “insurance premiums” Upgrading paid in the first two months of 2019 via its defensive protocols cost it the chance of keeping up with the stock market’s magnificent first-half returns, it’s good to see that Upgrading was back on track in the second quarter. Given it held a substantial level of cash when the market rebounded so strongly in January, Stock Upgrading’s first-half return of +14.5% is impressive. Rather than being discouraged by trailing the market so far this year, hopefully SMI members will be encouraged by earning such strong absolute returns — without having to abandon the safety net provided by Upgrading 2.0’s defensive protocols.

Bond Upgrading

If the levitating stock market was the main story of 2019’s first half, plummeting bond yields were a close second. The benchmark 10-year Treasury yield fell all the way from 2.69% to 2.00% by mid-year. The first rule of bond investing is that prices rise as yields fall, which meant the first half of 2019 was outstanding for bond investors. Bond Upgrading earned +3.3% in the second quarter, bringing its total return for the first half of 2019 to +6.1%.

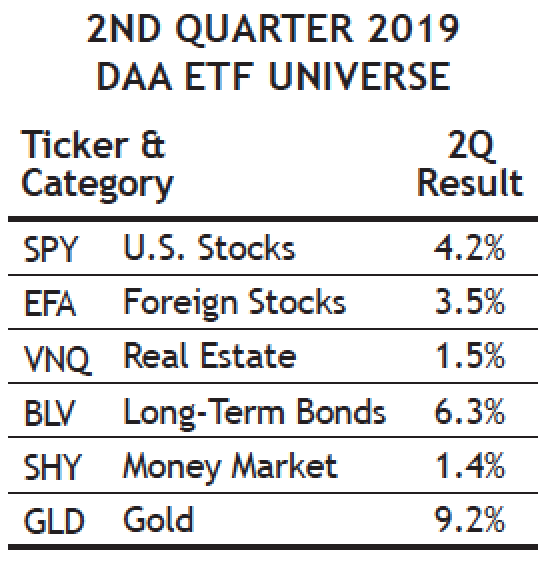

The second rule of bond investing is that the longer the duration of the bond, the more its price will move in response to interest-rate changes. This means that investors in long-term bonds have earned the best returns as rates have fallen. (This includes DAA investors, who have gained +12.7% in long-term bonds so far in 2019.) In Bond Upgrading, we’re more concerned about our bond holdings providing safety and stability than we are shooting for the highest gains, so we’ve purposely avoided the higher risks present in long-term bonds. Despite that safety tilt, Bond Upgrading still outperformed the broad bond market +3.3% to +3.0% in the second quarter. Bond Upgrading provided higher returns with less risk this quarter, which is a great combination.

Dynamic Asset Allocation (DAA)

DAA was the strongest performer of SMI’s strategies during the second quarter, earning +4.4%. This beat the stock market’s second-quarter return, even as DAA was able to avoid the roller coaster ride stock investors were taken on. The stock market had a solid second quarter overall, but came in just third among DAA’s six asset classes, behind both long-term bonds and gold.

The fact that DAA often runs “out of synch” with the stock market is a feature, not a bug. Yes, this can be frustrating when the stock market is rising and DAA doesn’t keep up. But the portfolio diversification DAA consistently provides is valuable in its own right by smoothing the overall returns of blended portfolios that allocate money to it.

Sector Rotation (SR)

While SMI’s other strategies navigated the rapid up-down-up reversals of the second quarter pretty well, SR felt the impact of those directional changes acutely. Due for a fund replacement at the beginning of May, SR unfortunately jumped aboard a high-flying tech fund just as the May swoon was beginning. That fund lost -14.3% in May and was the primary driver of SR’s -12.8% overall loss for the quarter.

While that type of rapid loss is rare even for SR, it is a potent reminder of both this specific strategy’s volatility and the speed at which market losses can erode any strategy’s past gains. SR’s current 10-year annualized gain of +17.8% still dwarfs the market’s +14.7%, but that gap was twice as wide just six months ago (a gap of 6.2% then vs. 3.1% now).

50/40/10

This portfolio refers to the specific blend of SMI strategies — 50% DAA, 40% Upgrading, 10% Sector Rotation — discussed in our April 2018 cover article, Higher Returns With Less Risk, Re-Examined. It’s a great example of the type of diversified portfolio we encourage most SMI readers to consider. As we saw again this quarter, the markets can shift suddenly between rewarding risk-taking and punishing it, so a blend of higher-risk and lower-risk strategies can help smooth your long-term path and promote the type of emotional stability that breeds sustained investing success.

A 50/40/10 portfolio would have gained +2.5% during the second quarter, a bit less than the broad market’s gain of +4.0%. While Stock Upgrading and DAA both outperformed the market, SR’s significant decline reduced the overall return of the portfolio. That’s disappointing, but it’s also unusual for SR to lag during a rising market, so hopefully this will be a rare exception. We continue to believe that over the full market cycle (bull and bear market), the performance of a 50-40-10 portfolio stands a good chance of beating the broad market—while protecting investors during bear markets when they are most prone to making costly mistakes. Whether you use this specific 50/40/10 strategy mix or a different combination, we think most SMI readers can benefit from blending these strategies in some fashion.