The stock market began 2019 with its strongest first-quarter gain since 1987, and one of its best first quarters ever. Coming off the heels of a wicked December drop, that outcome was way outside the mainstream expectation as the new year began.

The reason for this dramatic course change is easy to identify. In mid-December, with economic reports looking strong but the financial markets showing signs of weakness, investors were hoping the Fed would scale back their aggressive plans for more 2019 rate hikes while simultaneously shrinking its massive balance sheet. Instead, Fed Chairman Jerome Powell poked investors in the eye by saying there was no intention of scaling back those plans.

Many interpreted this statement as a sign that the Fed was no longer going to respond to every whim of the financial markets, as has been the trend since the financial crisis in 2008. As soon as the words came out of Powell’s mouth, the stock market started falling and was on the verge of bear-market territory by Christmas Eve.

Following a brief bounce into year-end, the stock market resumed its downside trajectory and a bear market seemed imminent. But on January 4, a mere three weeks after his previous comments, Chairman Powell reversed course by announcing the Fed actually was paying close attention to the financial markets, and that they were pausing their interest-rate hikes and balance-sheet reduction plans.

The response to this news was just as dramatic as the reaction had been weeks earlier. Investors heard, “The Fed still has our back!” and the stock market began to party like it was (literally) 1999 again.

The irony is that when economic reports were stronger in the fourth quarter of 2018, the financial markets were weak, fearing the Fed would continue tightening monetary policy in response to that economic strength. But as economic concerns grew during the first quarter of 2019, the financial markets rallied strongly, as further Fed action became less likely.

It’s not unusual for the markets to consider bad economic data to be good news late in bull-market cycles, precisely for the reason we saw here: it slows the Fed down from tightening monetary conditions. But it is telling that Fed policy has become so dominant in the minds of investors that the risk of a global economic slowdown seems less important than adding 0.25% to a 2.50% Fed Funds rate at a time of record-low unemployment and following a decade-long economic expansion.

Just-the-Basics (JtB) & Stock Upgrading

The timing of the Fed’s flip-flop couldn’t have been worse for Stock Upgrading. Had the Fed said in mid-December what they ultimately would say three weeks later in early January, we would have been spared a lot of aggravation. Instead, the late December plunge triggered Upgrading’s defensive protocols for the first time in live practice, and just the fourth time in the past 20 years (taking into account our backtesting).

With the market rallying immediately and powerfully from that January 4 announcement, the fact that Upgrading was defensively positioned was clearly detrimental. Thankfully, Upgrading phases in its defensive protocols and hadn’t moved very far into that process. So while it was disappointing to be on the wrong side of this whipsaw, Stock Upgrading still made +10.0% during the first quarter. That’s a fantastic absolute return for a quarter, which is only disappointing in comparison to the +14.1% gain of the stock market as a whole.

That 10% gain makes it easier to chalk up the difference as an unfortunate opportunity cost. Yes, we paid an “insurance premium” and the house didn’t end up burning down after all. But our portfolios will need that protection eventually, and occasionally we pay a premium like this to have it.

Just-the-Basics did better (assuming one didn’t apply Upgrading’s defensive signals), gaining +13.9%. An interesting dynamic was playing out between the large- and small-stock indexes that comprise 80% of JtB’s portfolio. Small stocks were slightly stronger than large for the first quarter as a whole, but the two groups were trending in opposite directions as the quarter came to a close. March saw the small-company Russell 2000 index lose -2.1%, while the large-company Russell 1000 index continued its first quarter gains by adding +1.7%.

More interesting than their March returns is the fact that the Russell 2000 finished the quarter -11.5% below its August 2018 high, while the large-company S&P 500 was a mere -3.3% below its September 2018 high. Small-company stocks began declining sooner last year, and stopped advancing sooner this year. Normally, small-company stocks lead during market rallies, but that wasn’t the case as the first quarter drew to a close.

Bond Upgrading

Inflation is the mortal enemy of bond investors, so when growth expectations were strong in late 2018, bond returns were poor. But the Fed’s January reversal, coupled with declining growth expectations, did wonders for the bond market. Bond Upgrading gained +2.7% during the first quarter, which is roughly an +11.25% annualized pace. The full bond market earned a bit more at +2.9%, but Bond Upgrading didn’t have any exposure to (riskier) longer-term bonds which pushed the overall bond-market’s return higher.

Another interesting dynamic as the first quarter closed was the disconnect between the bond- and stock-market outlooks. The bond market still seems pessimistic in its view of future economic growth and the risk of recession, as evidenced by low interest rates and the “inversion” of parts of the yield curve. Normally, longer-term bonds carry higher interest rates than shorter-term bonds. Inversion happens when this gets flipped and lower interest rates are charged for longer-term bonds than shorter-term bonds. This dynamic implies that bond investors see a high risk of economic weakness or recession in the future. In contrast, U.S. stock investors seem to have embraced the idea that the global economy is experiencing a short-term economic slowdown, but one that won’t have lasting impact. This is evidenced by the fact that some of the main market indexes recently hit all-time highs. Historically speaking, it has usually paid to side with the bond market when those two disagree, but that’s not always true. Time will tell which is reading the economic-growth tea leaves correctly.

Dynamic Asset Allocation (DAA)

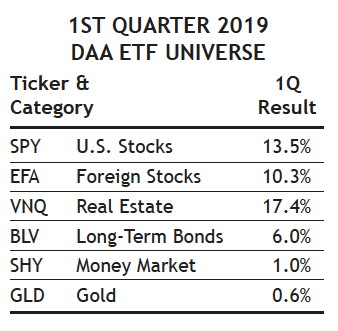

DAA’s first quarter gain of +5.1% reflects the fact that it entered 2019 in its most defensive posture. With no stocks in the portfolio, DAA was another victim of the Fed’s abrupt change of mind. While that’s frustrating, it’s also reassuring that even having DAA’s worst whipsaw scenario play out this quarter, the strategy was still nimble enough to produce gains at a rate that would annualize to 22%. In absolute terms (rather than relative), that’s a great quarter.

To have that type of upside potential despite being defensively positioned for a potentially imminent bear market — which is what late December was steering toward prior to the Fed’s course reversal — is pretty remarkable. Again, sometimes we have to pay insurance premiums for a while before the insurance pays off. But most people still regard insurance as a wise thing to have!

Sector Rotation (SR)

SR posted a strong first-quarter gain of +8.3%. Interestingly, SR was down in January when other stocks saw their strongest gains. But SR came on strong in February and March, producing an excellent overall quarterly return.

While 2018’s fourth-quarter decline put a significant dent in SR’s recent returns, the strategy has earned annualized gains of +21.6% over the past 10 years, making it the clear standout among SMI’s strategies during this bull market. But the fourth quarter stands as a warning about allocating too heavily to this aggressive strategy during what appears to be a late-stage bull market. The standout performers during the next phase of the market’s cycle are likely to be SMI’s more defensively-oriented strategies.

50/40/10

This portfolio refers to the specific blend of SMI strategies — 50% DAA, 40% Upgrading, 10% Sector Rotation — discussed in our April 2018 cover article, Higher Returns With Less Risk, Re-Examined. It’s a great example of the type of diversified portfolio we encourage most SMI readers to consider. As we saw again in the transition from 2018 to 2019, the markets can shift suddenly between punishing risk-taking and rewarding it, so a blend of higher-risk and lower-risk strategies can help smooth your long-term path and promote the type of emotional stability that breeds sustained investing success.

A 50/40/10 portfolio gained +7.4% during the first quarter. Despite starting the quarter in an extreme defensive posture, the portfolio was able to pivot quickly enough to still generate a nice quarterly gain. At some point, we’re going to need that defensive protection, but it’s good to know that we can still earn decent returns even when we occasionally get caught positioned on the wrong side of what the market is doing.

Overall, the first quarter provided a good illustration of how balancing return and volatility between the various strategies can produce a smoother ride and solid overall returns. Whether you’re using this specific 50/40/10 blend or a different combination, we think most SMI readers can benefit from blending these strategies in some fashion.